Escrow Kenya Review (Is it legit?)

This guide reviews Escrow Kenya's pricing, how it works and trustworthiness.

Muthoni W

Editor @ Quorage

I used Escrow Kenya to sell a seat through Facebook. I recommend it, especially because their support team was fully responsive throughout the transaction.

An escrow account is the most reasonable solution when you can’t trust a buyer to pay on delivery, and the buyer can’t trust you to deliver after they pay. So, the buyer deposits the money into an escrow account, and then you can send over the product. After the buyer receives and approves the product, you withdraw the money from the escrow account in minutes.

In this Escrow Kenya review, I share the way it works, the cost, and reputation. Read on.

What is Escrow Kenya?

Escrow Kenya is an online escrow service headquartered at Blessed House Business Center, opposite Garden City Mall along Thika Road. They offer mpesa payment and withdrawal. And a Lipa na Escrow API (a payment gateway like Paypal) for online shops. Escrow Kenya charges a 3% processing fee (or Ksh. 200 minimum).

Two actuarial science graduates, Robert Kamaru and Simon Karugu founded Escrow Kenya in 2018.

What is an escrow?

An escrow is an arrangement where a trusted third party holds the money or asset in a transaction. It’s the safest way to transact online. The buyer pays the third party, and then once they receive the product, the seller gets their money from the third party. Such third parties (escrow agents) are well established to resolve any disputes, like if the seller delivers a damaged product or the buyer rejects a good product.

Getting into an escrow is similar to signing a contract. Both the buyer and seller agree to their own terms and conditions of the transaction. And the money is only released once the terms and conditions have been met.

One big challenge with escrow accounts is high processing fees. For example, Escrow.com charges a $10 (roughly Ksh. 1,000) minimum processing fee. But closer home, Escrow Kenya has a Ksh.200 minimum fee.

Besides the processing fee, other possible costs for using escrow services are:

- Dispute resolution – if they resolve your dispute

- Cancellation fee – in case the seller cancels the transaction

- Withdrawal fee – from the escrow account to your bank account or mpesa

How does Escrow Kenya work?

If selling a product, you’ll create a contract in a few clicks on escrowkenya.com. The buyer will receive an invitation to accept the contract via email and SMS. They’ll then create an account to accept the contract. Once they accept, they deposit the amount through mpesa or bank transfer. You then deliver the product. And once the buyer approves it, you withdraw the money to your mpesa or bank account.

A buyer can also initiate the transaction using the same process (create an account and a contract). If selling a physical product, either the seller or buyer can pay the delivery fee. Or you can share the cost. In my transaction, I (the seller) paid the processing fee (Ksh.200), and the buyer paid the delivery fee once he received the seat.

The image below shows what a contract will look like on Escrow Kenya.

Here’s what you need to use Escrow Kenya:

- Your email and the buyer’s/seller’s email

- Your phone number and the buyer’s/seller’s phone number (make sure you use your mpesa number)

- An Escrow Kenya account

How much does Escrow Kenya charge?

Escrow Kenya charges 3% of the order cost or Ksh.200, whichever is the highest. For example, if you’re transacting an order worth Ksh. 5,000, you’ll pay Ksh.200 instead of Ksh.150 (3% of 5,000). And if transacting Ksh.8,000, you’ll pay Ksh.240 (3% of 8k).

The Ksh.200 minimum fee is not economical for transactions below 1k. But Escrow Kenya’s minimum fee is cheaper than Tradesure, which has a Ksh.250 minimum fee.

What payment options are available on Escrow Kenya?

Escrow Kenya currently offers bank account and mpesa payments. It’s a shame that they don’t use Paypal, Payoneer, or Wise.

You’ll see the Pay Now button after you have an active contract.

How do you withdraw from Escrow Kenya?

Escrow offers mpesa and bank transfer withdrawals. The phone number you use to sign up will automatically be your withdrawal number. And the name in your escrow account has to match that on your mpesa number. Even when using a bank transfer, the names must match; else, the withdrawal fails.

Once the buyer approves an order, you’ll withdraw the money in minutes. You won’t see the WITHDRAW button until you have money available for withdrawal.

If a buyer fails to approve the order, Escrow Kenya will automatically approve it after 3 days or 7 days if selling a motor vehicle.

Sidenote: I used a Telkom number to sign up for Escrow Kenya. So I had to contact support to change the number to my mpesa. You can’t edit your phone number after signing up. Fortunately, their support is super fast. On weekdays and Saturdays, Escrow Kenya is always available on WhatsApp or call at +254 703 300 000. So that’s the best way to contact them. On Sunday, rely on the chat app on the website because they’re usually closed. And you can email them any day at support@escrowkenya.com.

What happens when the buyer and seller disagree?

Escrow Kenya offers dispute resolution at a fee. If unsatisfied, raise a dispute order within the system before it’s automatically approved (3 days for most goods and 7 days for motor vehicles). You’ll then have 2 calendar days to resolve the dispute between yourselves. Within that time, you’ll communicate in Escrow Kenya’s chat system so that the support team can monitor the conversation. If both parties agree, then the seller can cancel the transaction, or the buyer can release the money.

But if both parties can’t agree, escalate the dispute so that Escrow Kenya’s dispute team takes over. You’ll need to do this within 10 calendar days; else, the order is automatically approved and the money released to the seller. After escalating the dispute to the support team, they’ll review it and suggest solutions like a partial or full refund. But before a buyer receives a full refund, they have to ship the product and provide shipping proof and tracking information. Or the seller has to acknowledge that they’ve received the product.

Main takeaway?

- Have records of all your conversations until the order is marked COMPLETE

- Communicate using only the phone number or email address in the contract

- Use a shipping service that offers online tracking (I used a Bolt rider)

Is Escrow Kenya legit?

From my experience, Escrow Kenya is 100% legit. They’ve been in the business since 2018, and they have a 4.5/5 star rating from 103 Google My Business reviews and 4.9/5 from 175 Facebook reviews. Plus their customer support is fully responsive in case of anything.

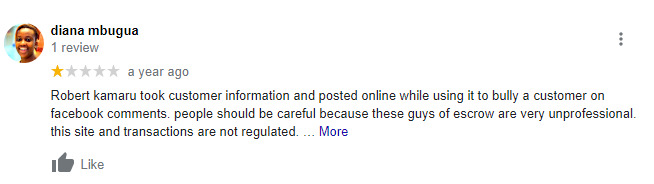

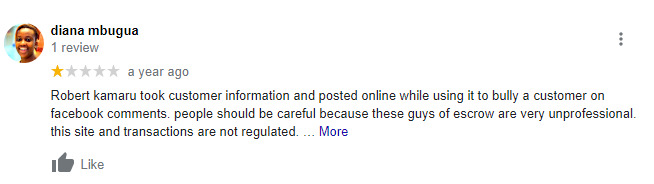

But I saw two critical reviews on their Google My Business profile and had to reach out to Escrow Kenya.

One review claimed that the founders (Simon and Robert) harass people online.

And here’s what Escrow Kenya says about that:

“We always appreciate it when real customers leave reviews about their experience. However, as with other businesses that have an online presence, we have, unfortunately, faced the challenge of spammers posting malicious reviews to dissuade potential partners from working with us. The negative reviews that you shared came at a time when we were seeking funding for the KCB Lion’s Den show. We believe the intention was to discredit the company and our founders. Reason: the allegations are untrue and the reviewers did not attach any evidence such as screenshots backing the claims—as one would typically expect of an agitated customer.”

Another reviewer expressed their concern about Escrow Kenya’s licensing.

Escrow Kenya says, “At this time, internet escrow services are not explicitly regulated in Kenya, and we do not make claims as to being licensed or regulated. However, we have made a consultation with the CBK seeking guidance on the regulation of internet escrow services.”

So, should you use Escrow Kenya? Absolutely! Their processing fees are low, you receive the money in your mpesa almost instantly, and their customer support has never failed me.

Click here to complete your transaction on Escrow Kenya.

Full disclosure: I’ve used my Escrow Kenya affiliate link in this post. As always at Quorage, the commision does not change our approach to honest reviews as demonstrated in the content. Do use my affilate link to support our work with commissions!